August 2024

In the Spring, we gave you a report about consumers feeling pinched by household expenses and how that was affecting their discretionary spending.

As we head into Q4 2024, there is an additional report from Morning Consultant Economic Intelligence that provides more detail about specific consumer groups. In summary, facts from the report are:

- U.S. adults’ discretionary spending is down significantly year-on-year, contributing to a recent softening in overall consumer demand.

- One of the main culprits for the slowdown? Urban-located adults have cut back dramatically on non-essential purchases such as recreation or home furnishings compared to 2023.

Consumer spending has weakened notably since last year. As of July 2024, U.S. adults on average reported spending 8.8% less than in the same month a year ago, after accounting for inflation and seasonal factors. While softer reported spending was broad-based, discretionary categories showed a steeper drop, declining 15.2% over the past year. Fatigue over elevated price levels, several years of depleted savings ability, higher interest rates and a cooling labor market could all be playing a role in slowing demand. While personal financial conditions remain supportive enough that households are still for the most part managing to cover expenses, the appetite to splurge has clearly waned among U.S. consumers.

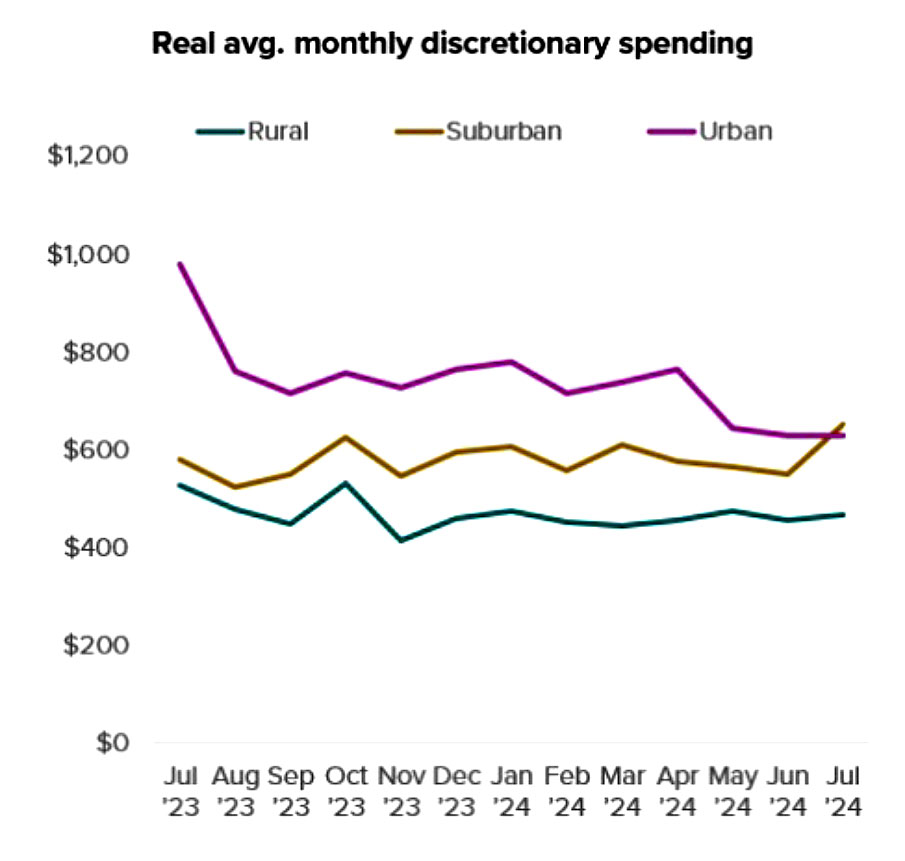

A group with a notable shift in spending habits is adults living in urban areas. These consumers have traditionally spent higher amounts on discretionary categories than their suburban or rural counterparts. Intuitively, proximity to high-density retail, entertainment and events might encourage more purchases of non-essential goods and services by city inhabitants. Recently, however, this type of spending has tapered off among those living in urban areas. In fact, discretionary spending levels among suburban-located adults in July surpassed the urban cohort’s average discretionary spending amounts for the first time since tracking for these categories began in December 2021.

Discretionary categories include: Education, Restaurants, Recreation, Personal care services, Personal care products, Hotels, Home furnishings, Apparel, Alcohol, Airfare.

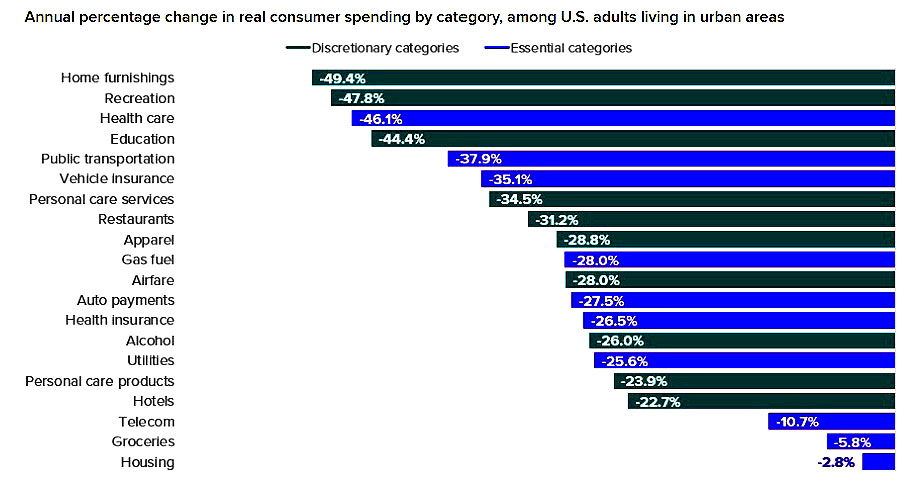

Categories driving spending slowdown among urban adults

Urban adults are spending less across the board. However, discretionary categories such as furniture and recreation had some of the largest declines compared with July 2023. Less homebuying and generally weak demand for durables may be preventing home furnishings purchases, while recreation was a category that saw such strong growth in 2023 that some normalization was perhaps inevitable. Both goods and services were subject to budget cuts, with urban consumers purchasing less apparel while also trimming restaurant and personal care spending. Only the most basic essentials–like housing, groceries, internet and phone services–had relatively smaller downshifts in inflation-adjusted spending, perhaps indicative of trading down to cheaper alternatives when possible, rather than cutting back altogether.