Historically, moderate inflation and low unemployment made measures of consumer sentiment go up. Currently, consumer sentiment is far lower than what the data would suggest it should be, based on historical patterns, the researchers noted.

The University of Michigan’s index of consumer sentiment, a measure of how people feel about the economy and their own finances, has been hovering near its lowest in decades. That is despite the unemployment rate being near a 50-year low, and inflation having fallen to a tame 3.1% annual rate from its height of 9.1% in June of 2022, according to the Consumer Price Index.

“Consumers, unlike modern economists, consider the cost of money part of their cost of living,” wrote Marijn Bolhuis, an economist at the IMF, together with Harvard economists Judd Cramer, Karl Oskar Schulz, and Lawrence Summers.

High interest rates have pushed car payments over $1,000 a month for many buyers. The interest payment on a new car loan has increased more than 80% since the start of the pandemic," the researchers wrote. "It is not surprising that this would affect how consumers feel about the economy.” Car insurance is up 20% year-over-year.

Data economists taking the temperature of the economy have become disconnected from the financial realities that people face in their everyday lives, especially for major purchases that are typically made on credit, like houses and cars.

“Since these purchases are integral to American consumers’ sense of their economic well-being but their full price is not included in official inflation measures, it is no wonder that sentiment lags traditional measures of economic performance,”

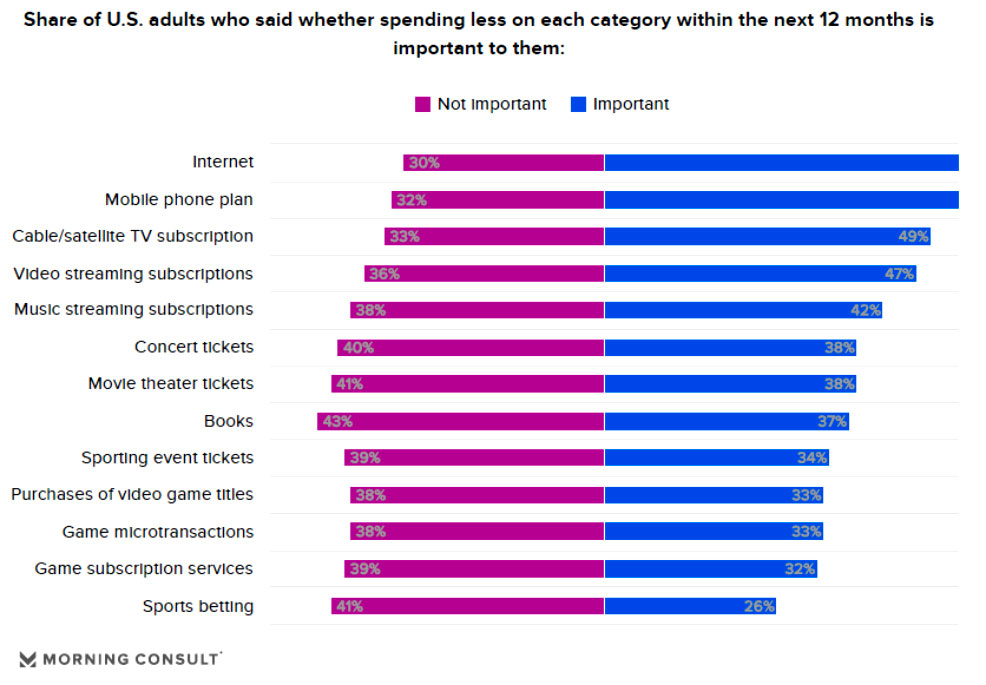

Consumers are as concerned about price levels as they are about price growth. When asked about their concern for each, consumers were slightly more likely to be worried about prices growing (88%) than they were to worry about the prices remaining above where they were in 2019 (85%).

Top Household Expense Increases – Outside of Housing and Transportation

Personal Services: Up 5% year-over-year

Repairs and Maintenance: Up 6.5%

Water, Utilities, Trash Services: Up 5%

Pet Services: Up 6%

Food at Home: Up only 1% year-over-year but up 25% since 2020

What’s Happening in California

Prices have grown about 20% overall since 2020, according to an analysis by the California Legislative Analyst’s Office based on the most recent consumer price index data. Over the past couple of months, prices in California appear to have risen slightly more than the country, according to data from the Bureau of Labor Statistics. Continued rising prices are why many Californians are struggling in an economy that is widely considered to be doing OK because the nation has avoided a recession.

On the services side, some California residents are struggling to get affordable auto insurance, with premiums rising 17.7% from 2023 to 2024, according to Bankrate.com. Prices for electricity have also increased, as regulators approve rate hikes by major utilities such as PG&E.

As for rent, “shelter is the major driver of services inflation in the inflation numbers,” said Jerry Nickelsburg, senior economist for the UCLA Anderson Forecast. Rent in California is 38% higher than the national median, according to real-estate listings company Zillow, the median rent of $2,755.

So, what would make consumers less unhappy with high prices? High inflation reduces purchasing power, making consumers’ money go less far. Purchasing power can be boosted through increasing wages or declining prices. When asked if they would rather prices go down or their income to go up, consumers were more likely to say they would prefer prices to go down (63%) — in other words, consumers want deflation.

Movie tickets and concession prices are higher – but there is good news.

Movie theaters have historically demonstrated remarkable resilience during economic downturns. Despite the challenges posed by recessions, the theatrical movie business has often weathered the storm. Over the last eight recessions, the box office has increased six times, and admissions have gone up five times. This surprising resilience suggests that movie theaters are not as vulnerable to economic fluctuations as other industries.

True, ticket prices are higher than 10 years ago, but adjusting for inflation reveals that it was more expensive to go to the movies in the 1970s. For instance, an average ticket in 1978 cost $2.34, which would be equivalent to $9.46 today. Just like everything else, inflation plays a role. Over the last two decades, the average cost of a movie ticket has more than doubled.

Moviegoers understand that part of the magic of going to the movies lies in the experience. The big screen, booming sound, and communal atmosphere create a unique setting. And interestingly, research shows that committed moviegoers (those who attend even during low-attendance periods) are more willing to consistently pay for theater food, regardless of the film.

The Bottom Line – Understand what the average consumer is managing with their household budgets and remind them how much their patronage at your theater is appreciated.